Dark Fiber and Enterprise Fiber providers enable the core connectivity for internet traffic globally by connecting towers, data centers, office buildings, homes and more into the broader global network. In part one of this two-part fiber series, we provide an overview of the fiber segment of digital infrastructure. Specifically, we focus on the sub-segments of fiber affecting businesses.

Below, we breakdown the key characteristics of dark fiber and enterprise fiber, who the major providers are, and who the key customers are in different industries. Additionally, we reveal one of the big secrets of the telecom industry, being that no carrier owns its entire network.

Fiber – Connects Digital Infrastructure

Fiber optic cables consist of bundled glass strands that transfer data signals into optical light. Specifically, optical equipment is used to transform these data signals into light. The light then travels along fiber threads and is re-converted, at the other end of the fiber strand.

Indeed, fiber is the “glue” that connects the entire digital infrastructure ecosystem together. Specifically, fiber is the connective tissue that enables all of the other three segments of digital infrastructure to function, including towers, data centers, and small cells & DAS.

Fiber – Categorizations by End User

Fiber is a part of digital infrastructure that has numerous applications. Indeed, there are two overall categories to group fiber into, in order to help differentiate its various business models. Specifically, i) Business-to-Business (B2B) Fiber and ii) Business-to-Consumer (B2C) Fiber.

(1) Business-to-Business (B2B) Fiber

Business-to-business fiber deployments have two sub-categories i) dark fiber and ii) enterprise fiber.

Dark Fiber (or Wholesale Fiber)

Dark fiber is typically procured via a long-term lease, which requires a recurring payment, on a term between 10 years and 25 years. Additionally, dark fiber leases can take the form of an Indefeasible Right of Use (IRU), which is a one-time payment, for a contract extending up to 35 years and even 50 years.

Enterprise Fiber (or Lit Fiber)

Enterprise fiber typically includes four products: Wavelength, Ethernet, IP (Internet Protocol), and SONET (Synchronous Optical Networking).

(2) Business-to-Consumer (B2C) Fiber / Broadband

Business-to-consumer fiber deployments have two sub-categories i) Fiber-to-the-Node and ii) Fiber-to-the-Home.

Fiber-to-the-Node (FTTN)

AT&T and Lumen Technologies are examples of companies that have the largest Fiber-to-the-Node (FTTN) deployments.

Fiber-to-the-Home (FTTH)

Verizon Fios is an example of one of the largest Fiber-to-the-Home (FTTH) deployments.

In part one of this two-part series, we focus on Business-to-Business (B2B) Fiber. Indeed, we discuss Business-to-Consumer (B2C) Fiber in detail, in our follow-up article here.

How are Dark Fiber and Enterprise Fiber Networks Measured?

Route Miles

Route miles represent the actual number of non-overlapping miles that a fiber network traverses.

Strand Miles

Strand miles represent the number of route miles in a network multiplied by the number of fiber strands within each cable on that network. For example, if a 10-mile network segment has 150-count fiber, it would represent 10 x 150 = 1,500 fiber strand miles.

Classifications of B2B Fiber – Different Network Sections

Broadly, fiber for business purposes can either provide land-based or submarine communications services. Thus, the two classifications for fiber that connect global networks are i) terrestrial fiber and ii) subsea cables.

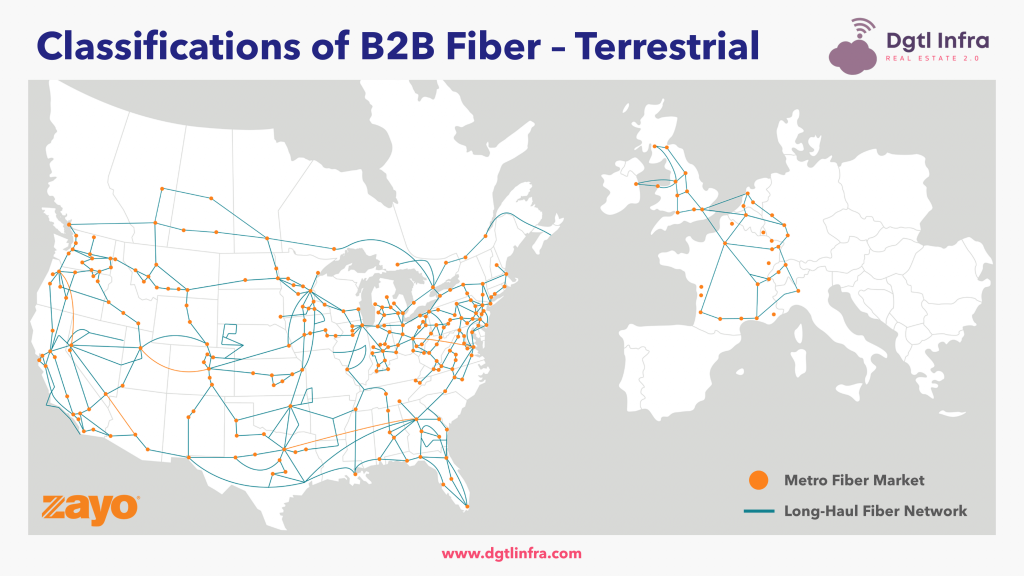

(1) Terrestrial Fiber

Below is a fiber network map shown for Zayo, one of the largest providers of dark and enterprise fiber. Indeed, Zayo has a network spanning over 133k fiber route miles and 13.2 million fiber strand miles. Overall, this represents an average of 99 fibers per route.

Metro (or Intra-City) Network Sections

Metro networks have optical fiber that runs, within the same city, from the central router, into routers located in the fiber provider’s “on-net” buildings (e.g., office building). Specifically, metro fiber runs in a ring architecture, which provides redundancy. Therefore, if the fiber is cut, data can still be transmitted to the central router by directing traffic in the opposite direction around the ring.

Metro fiber has high-count fiber cables, sometimes having more than 800 fibers per cable. Furthermore, pricing on metro networks is relatively stable. Indeed, this is because carriers emphasize the capabilities and services that they are able to provide. In turn, competition is driven less on the basis of price.

Long-Haul and Regional (or Inter-City) Network Sections

Long-haul and regional networks use optical fiber to connect together different metro markets and major cities across the globe. For example, long-haul and regional networks connect on-net buildings in Chicago and New York. Specifically, long-haul and regional fiber connects on-net buildings in small and mid-sized markets back to cloud data centers, colocation facilities, and wireless switching centers, in larger markets.

In terms of pricing, long-haul and regional networks, operate under wholesale transit pricing. Indeed, wholesale transit pricing continues to decline as the supply of capacity on long-haul and regional networks remains exponentially greater than the demand. Therefore, the only differentiating characteristic between long-haul and regional network providers is price.

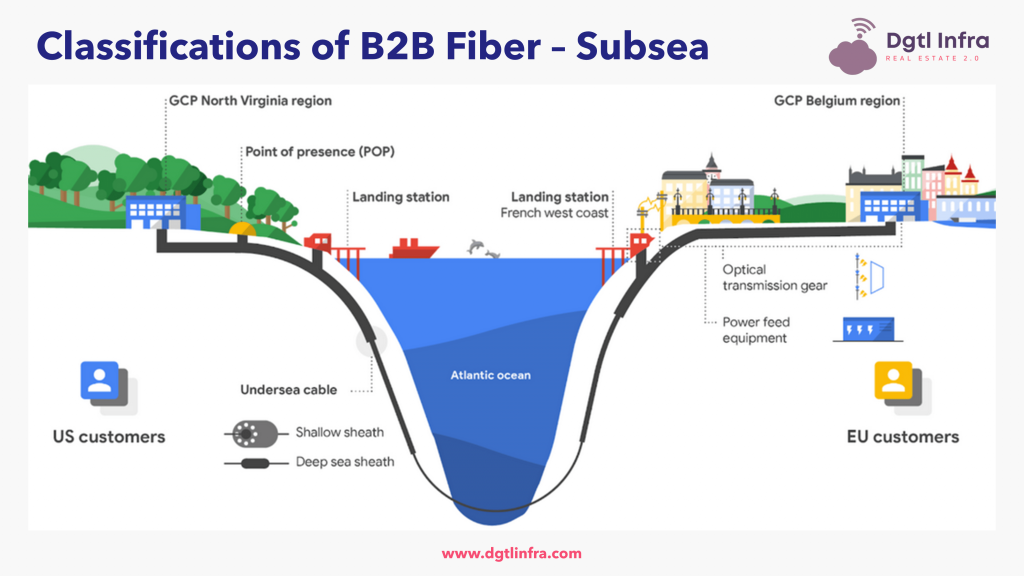

(2) Subsea Cables

Subsea cables carry 99% of all international telecommunications traffic for business, personal and government use. Indeed, fiber providers have global networks, and these connect via transoceanic fiber, known as subsea cables. For example, a fiber provider like Lumen Technologies connects the North America, Europe, Asia, South America, and Australia portions of its network through subsea cables.

Below is an example of Google Cloud connecting its data center in Northern Virginia (left) to another one of its data centers in Belgium (right).

From both the Northern Virginia and Belgium data centers, Google Cloud runs terrestrial fiber to “cable landing stations”. Indeed, these cable landing stations are buildings on both sides of the Atlantic Ocean.

From each cable landing station, subsea cables are run on long the depth of the ocean floor, across the Atlantic Ocean. In turn, this creates the “physical” link of connectivity between the United States and Europe.

Furthermore, Google Cloud can either build its own subsea cables or lease fiber pairs on the subsea cables of third-parties. In doing so, Google Cloud can ensure it has adequate international connectivity to provide services for its customers.

Why are Dark and Enterprise Fiber Networks So Important?

Data demand continues to grow and will require additional capacity on existing dark fiber and enterprise fiber networks for data transmissions. Specifically, global internet traffic will grow 25% per year, primarily from video traffic growth. While most of that traffic growth will come from consumer video consumption, enterprise IP traffic will also grow 30% per year. Specifically, enterprise IP traffic will be driven by video adoption and migration to the cloud.

Furthermore, there are homes, offices, schools, and businesses that still rely on legacy copper to provide internet and voice services. Indeed, copper is inferior to fiber, in terms of speeds, signal transmission distance and electromagnetic interference.

Finally, telecom providers have fiber footprints in certain geographies, but also rely on third-parties. Indeed, third-parties provide fiber connectivity for telecom providers, where it would not be cost-efficient for them to build.

Business-to-Business Fiber (B2B) – Overview

(1) Dark Fiber (or Wholesale Fiber)

Dark fiber is the leasing of individual fiber optic cable strands. Specifically, dark fiber provides dedicated high bandwidth, fixed network capacity. However, dark fiber does not provide any communications services across the fiber. Therefore, a dark fiber network is leased with no modulating electronics or optronics equipment, whereas an enterprise fiber network is. For example, this equipment would include optical multiplexers and routers, bought from companies like Cisco and Juniper.

For dark fiber networks, the customer (i.e., carrier) provides the electronics to light the fiber. Additionally, the customer assumes responsibility for configuring, monitoring, and operating the network service that they decide to run. Indeed, the network can be customized to run multiple protocols over a single strand of fiber.

Consequently, dark fiber is known as a dumb pipe until the customer lights up the fiber with electronics or optronics equipment.

Physical Asset of Dark Fiber

A dark fiber provider builds the fiber route, lays the conduit (i.e., rigid tubing), and then lays down the dark fiber. Currently, companies are building new dark fiber with 240 to 480 strands of fiber, which is very dense. Historically, dark fiber routes built 10 years ago, would only have 20 strands or 40 strands of fiber. Thus, older dark fiber routes have much less capacity.

Indeed, the ability to add more fiber in a dark fiber network is limited by its type of deployment. For example, it is very difficult to add fiber strands to a network, unless fiber is deployed in a conduit.

Customers of Dark Fiber – Overall

Dark fiber is the ideal solution for sophisticated companies that have large bandwidth needs, have expertise to manage them, and want more control over their networks. Specifically, dark fiber is known as “carrier-to-carrier” traffic, where connectivity services are provided for wireless carriers (e.g., AT&T). For example, the dark fiber owner provides connectivity to the wireless carriers’ towers and small cells.

Overall, other key customers groups for dark fiber include very large consumers of bandwidth. For example, these bandwidth consumers include Internet Service Providers (ISPs), cloud service providers and media & content companies. Additionally, international carriers (e.g., Vodafone, Telefónica) that need traffic in the United States are another larger customer group of dark fiber.

Customers of Dark Fiber – Specific

Below are examples of specific customers of dark fiber, which fall into four key groupings.

Firstly, Wireline customers include Zayo, Verizon, Windstream, AT&T, Cogent Communications, and Lumen Technologies. Indeed, many of these “wireline” customers are also providers of dark fiber themselves. This notion emphasizes our earlier point, being that no fiber provider owns its entire network. In turn, each of these wireline customers needs to lease capacity from other fiber providers.

Secondly, Wireless Carriers include Verizon, AT&T, T-Mobile, DISH Network, and U.S. Cellular. Indeed, wireless carriers have a tendency to lease dark fiber for backhaul, rather than using Ethernet circuits (which are a form of enterprise fiber services).

Thirdly, Data Center and Cloud Service Providers include Equinix, Digital Realty, CyrusOne, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Indeed, dark fiber has become increasingly important to cloud service providers building their own wide area networks (WANs). Dark fiber allows cloud service providers to interconnect their data centers in different global markets.

Finally, Content Providers include Apple, Disney, Facebook, Netflix, Microsoft, and Riot Games. Indeed, content providers are increasingly prioritizing control over their content and thus use dark fiber, over traditional enterprise fiber services. Furthermore, demand for dark fiber will continue to increase as large internet content providers build-out their own networks. Specifically, these content providers need to support their growing over-the-top (OTT) services like Netflix, Hulu, Prime Video, Disney+, Peacock.

Customers of Dark Fiber – Fiber-to-the-Tower (FTTT) Backhaul

Fiber-to-the-Tower (FTTT) / Backhaul is a notable customer group and use case for dark fiber. Wireless carriers (e.g., AT&T, Verizon, and T-Mobile) use dark fiber to connect and backhaul their tower base stations to central sites. Indeed, tower base stations use immense and increasing amounts of data traffic, particularly with the introduction of 5G to consumers.

Backhaul is the physical connection between the tower radio base station and the core network. Specifically, smartphones transmit and receive their signals from radio base stations, which typically sit on top of buildings or towers. Indeed, core networks are usually situated in central office locations of the wireless carrier and are usually far from these radio base stations.

Overall, the most commonly used backhaul methods to connect networks are microwave links, copper connections and increasingly fiber. Indeed, efficient backhaul of data traffic improves throughput and therefore user experience on the 5G network. Importantly, these improvements can only be done through fiber-optic backhaul solutions.

Customers of Dark Fiber – Small Cells Backhaul

The increase in small cell deployments as part of the 5G network, is another factor which makes dark fiber imperative. In particular, small cells and dark fiber are necessary for high-band (or millimeter wave) spectrum deployments. Indeed, dark fiber is the primary medium to backhaul data traffic over small cells.

Similarly, wireless carriers including AT&T, Verizon, and T-Mobile are the key customers for backhaul services of small cells.

Lease Profile and Service Sold – Dark Fiber

Below we provide two examples of a typical dark fiber lease to a i) cloud service provider and ii) enterprise. Notably, customers typically lease dark fiber in pairs to account for uplink and downlink.

Firstly, Amazon Web Services (AWS), Microsoft Azure, or Google Cloud will lease 4 pairs to 8 pairs of fiber. Indeed, cloud service providers are more likely to repeatedly lease dark fiber in smaller increments, as and when they need additional capacity.

In contrast, enterprises (e.g., American Airlines), will often lease 20 pairs of fiber at a time. Importantly, the lease will often be in larger capacities to account for a specific project or major corporate initiatives. However, leasing will be less frequent as compared to cloud service providers.

Contract Terms of Dark Fiber

Dark fiber is typically procured via a long-term lease, which requires a recurring payment, on a term between 10 years and 25 years. Additionally, dark fiber leases can take the form of an Indefeasible Right of Use (IRU), which is a one-time payment, for a contract extending up to 35 years and even 50 years.

Ordinarily, dark fiber customers do not own the fiber. However, customers effectively control the dark fiber through contractual renewal rights. Additionally, dark fiber providers ensure that the fiber is in good working condition throughout the term of the lease, for the customer.

Pricing of Dark Fiber

Pricing for dark fiber leases include several variables. In terms of the physical asset, pricing characteristics include the number of fiber strands, and number of route miles. Additionally, factors including supply & demand on the route, and the service provider offering dark fiber, also factor into pricing.

Dark fiber leases are often recurring payments which are at a fixed rate and paid on a monthly basis. However, dark fiber leases often include annual price escalators to account for inflation. Indeed, some customers pay an upfront lump sum, along with an annual maintenance charge, which is known as an Indefeasible Right of Use (IRU).

(2) Enterprise Fiber (or Lit Fiber)

Enterprise fiber is where the service provider lights the fiber and enables connectivity for the customer. Indeed, the enterprise fiber service provider operates the modulating electronics and optronics equipment for the network. In contrast to enterprise fiber, dark fiber does not provide these communications services across the fiber.

Physical Asset of Enterprise Fiber

Enterprise fiber owners take an existing fiber route, cut the fiber and build a fiber lateral into an enterprise. For example, enterprises can include office buildings, industrial parks, or corporate headquarters.

Customers of Enterprise Fiber – Overall

Enterprise fiber is the supply of connectivity services to businesses or enterprises, typically medium and large. For example, these customers can include office buildings, government agencies, financial services, educational systems, and healthcare organizations.

Customers of Enterprise Fiber – Specific

Below are examples of specific customers of enterprise fiber, which fall into three key groupings.

Firstly, Finance customers include Morgan Stanley, Goldman Sachs, Barclays, Citi, New York Stock Exchange, and Bloomberg.

Secondly, Public Sector & Healthcare customers include the United States Department of Homeland Security, the Johns Hopkins University School of Medicine, the National Institutes of Health, Highmark Health, and the Children’s Hospital of Philadelphia.

Thirdly, Manufacturing & Transportation customers include ExxonMobil, American Airlines, United Airlines, United Parcel Service (UPS), and Walmart.

Lease Profile and Service Sold – Enterprise Fiber

Enterprise Fiber services include traditional telecommunications offerings like wavelength, Ethernet, IP, and SONET services. Indeed, these services are sold to an enterprise user (as shown above). The fiber provider uses its own optronics to manage the network. In turn, enterprise fiber allows the customer to focus on its core business instead of operating the fiber network, which the customer must handle in dark fiber.

Many service providers sell enterprise fiber services, instead of dark fiber, since enterprise fiber services generate much higher recurring revenue. For example, selling lit Ethernet services to four wireless carriers is far more attractive economically, as compared to leasing dark fiber to only one wireless carrier.

Contract Terms of Enterprise Fiber

Enterprise fiber lease contracts typically range from 2 to 5 years in duration. Indeed, the enterprise fiber owner provides access to the network for a recurring, fixed or in some instances usage-based fee.

Pricing of Enterprise Fiber

In terms of pricing, customers pay for enterprise fiber depending on the amount and type of bandwidth service they purchase. Specifically, bandwidth capacity typically ranges from 1 gigabit per second of capacity to 100 gigabits per second of capacity.

Dark Fiber and Enterprise Fiber Network Providers

Dark Fiber – Overview of Providers and Competition

Providers of dark fiber are limited to carriers with ample supply of fiber to meet specific customer demands. For example, competition includes Lumen Technologies, Zayo, Uniti Group, and Crown Castle. Overall, competition in dark fiber is less intense than enterprise fiber. Indeed, the dark fiber business also has lower churn than enterprise fiber, but requires higher capital investment to build the network.

The incumbent telecom companies, like AT&T and Verizon, and cable companies, like Comcast and Charter, typically do not offer dark fiber services. Indeed, this is due in-part to cannibalization risk and a desire to offer bundled solutions. Specifically, telecom and cable companies fear cannibalizing their existing business, if they were to offer dark fiber services. For example, by enabling another service provider to lease their dark fiber, these companies would be allowing that service provider to offer competing enterprise fiber services.

Finally, one of the big secrets of the telecom industry is that no carrier owns its entire network. Therefore, each carrier also leases fiber from virtually all the top dark fiber providers. For example, the network backbone of Cogent Communications is leased on Indefeasible Right of Use contracts from 262 different dark fiber suppliers. This notion of sharing networks, enhances the importance of dark fiber.

Enterprise Fiber – Overview of Providers and Competition

Enterprise fiber providers are dominated in the United States by AT&T, Verizon, and Lumen Technologies. Indeed, these three companies are known as the incumbent providers. Additionally, cable companies like Charter Communications have made inroads into enterprise fiber, but mainly focus on connectivity for small and medium-sized businesses.

Overall, enterprise fiber is an intense competitive environment. Specifically, enterprise customers typically have 4 to 5 connectivity options to choose from within their market. Indeed, these options include both large telecom incumbents and cable providers.

Given the intense competition and the short contract duration (i.e., 2 to 5 years), enterprise fiber has high churn. However, it also has high gross growth, before churn, making net growth of enterprise fiber ~3%. The top United States providers of enterprise fiber include AT&T, Verizon, Lumen Technologies, Charter Communications, Frontier Communications, Cogent Communications, and Windstream.

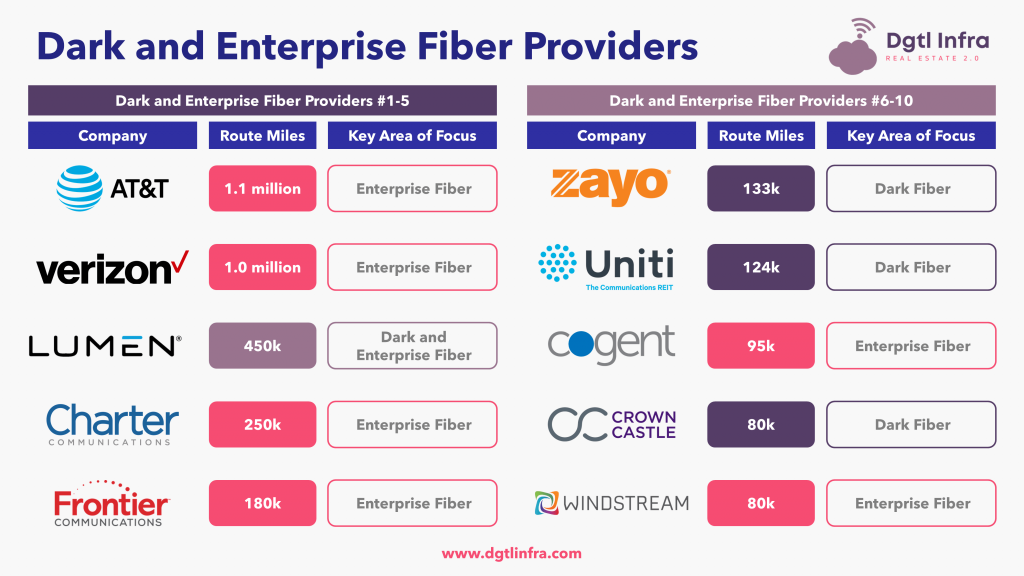

Top 10 Dark Fiber and Enterprise Fiber Network Providers in the United States

Below are the ten largest dark fiber and enterprise fiber providers in the United States, ranked by fiber route miles. Additionally, each fiber provider’s key area of focus, in terms of dark fiber and enterprise fiber, is highlighted.

AT&T

AT&T has 1.1 million fiber route miles. Specifically, the company’s key area of focus is enterprise fiber, with a ~30% enterprise market share.

Verizon Communications

Verizon has 1.0 million fiber route miles. Specifically, the company’s key area of focus is enterprise fiber, with a ~20% enterprise market share.

Lumen Technologies

Lumen has 450k fiber route miles. Specifically, the company’s key area of focus is both dark and enterprise fiber networks, with a ~20% enterprise market share.

Charter Communications

Charter has 250k fiber route miles. Specifically, the company’s key area of focus is enterprise fiber, with a growing ~7% enterprise market share.

Frontier Communications

Frontier has 180k fiber route miles. Specifically, the company’s key area of focus is enterprise fiber, with a shift towards fiber from its declining legacy copper network.

Zayo Group

Zayo has 133k fiber route miles. Specifically, the company’s key area of focus is dark fiber. Indeed, dark fiber comprises ~1/3rd of its fiber revenues and enterprise fiber, comprises ~2/3rds of its fiber revenues. Although Zayo’s enterprise fiber business outweighs its dark fiber business, in terms of revenues, the company remains one of the key dark fiber providers globally.

Uniti Group

Uniti has 124k fiber route miles. Specifically, the company’s key area of focus is dark fiber and Windstream (see below) represents 65% of Uniti’s revenue.

Cogent Communications

Cogent has 95k fiber route miles. Specifically, the company’s key area of focus is enterprise fiber, with a significant business in connectivity for office buildings.

Crown Castle

Crown Castle has 80k fiber route miles. Specifically, the company’s key area of focus is dark fiber, which supports more than 70k small cell networks.

Windstream Holdings

Windstream has 80k fiber route miles. Specifically, the company’s key area of focus is enterprise fiber, with a significant transport services business and a desire to shift from its legacy copper network.

SOURCE: https://dgtlinfra.com/dark-and-enterprise-fiber-network-providers/